Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store.

The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California. The information presented in this site is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor.

Nothing in our research constitutes legal, accounting or tax advice or individually tailored investment advice. Our research is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive or obtain access to it. Our research is based on sources that we believe to be reliable.

Some discussions contain forward looking statements which are based on current expectations and differences can be expected. All of our research, including the estimates, opinions and information contained therein, reflects our judgment as of the publication or other dissemination date of the research and is subject to change without notice. Further, we expressly disclaim any responsibility to update such research. Past performance is not a guarantee of future results, and a loss of original capital may occur. None of the information presented should be construed as an offer to sell or buy any particular security. Apple Inc. is one of the very few companies that had successfully sensationalised the American stock market since its launch.

Headquartered in Cupertino, California this technological behemoth was co-founded by Steve Jobs, Ronal Wayne and Steve Wozniak in 1976. The company was launched with a view to innovate the field of technology and aimed to create unrivalled products for the lovers of superior experience. Its premium products include iPhones, iPads, Apple Watches, Apple cards, Macs, Apple News+, Apple Pay, and Apple TV+. This is a bundled plan comprising four major Apple services namely, Apple Music, Apple TV+, Apple Arcade, and iCloud.

Customers get access to all four against low monthly charges. Among all the advanced gadgets engineered by Apple Inc, iPhones have especially captured attention all around the world and is currently one of the highest selling smartphones. This company started its business with a single product Apple I, a computer designed and hand-built by Wozniak. To financially support this creation, Jobs sold his Volkswagen Microbus, and Wozniak sold his calculator HP-65.

The hard work and sacrifices of the founding members paid off when Apple laid hold of the biggest stock market launch in history after Ford. It kept growing from both technological and financial aspects, and by the beginning of the 21st century, Steve Jobs had become the face of Apple. After his demise, many have criticised the company's products for their lack of innovation, but its market has consistently retained its loyal customer base.

Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The Company's products include iPhone, Mac, iPad, and Wearables, Home and Accessories. IPhone is the Company's line of smartphones based on its iOS operating system. Mac is the Company's line of personal computers based on its macOS operating system. IPad is the Company's line of multi-purpose tablets based on its iPadOS operating system.

Wearables, Home and Accessories includes AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch and other Apple-branded and third-party accessories. AirPods are the Company's wireless headphones that interact with Siri. Its services include Advertising, AppleCare, Cloud Services, Digital Content and Payment Services. Its customers are primarily in the consumer, small and mid-sized business, education, enterprise and government markets.

Apple's financial performance, including its share price, relies heavily on the sales of its products. A high flier through much of its recent history, Apple stock hit new all-time highs toward the end of 2021, with a market capitalization approaching a record $3 trillion. Moody's Daily Credit Risk Score is a 1-10 score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company's liability structure. IPad is the Company's line of multi-purpose tablets based on its iPadOS...

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +25.25% per year. These returns cover a period from January 1, 1988 through December 6, 2021. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. The article below features a method for picking individual stocks. If you're a new investor, we suggest starting out by investing in index funds or mutual funds.

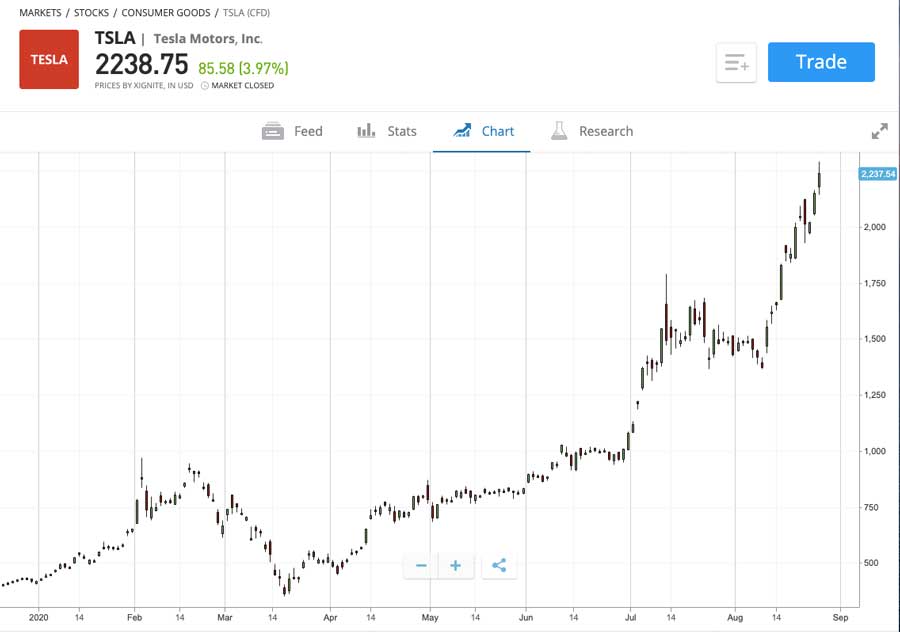

This will keep your portfolio diversified and reduce risk while you learn more about the stock market. Alternatively, assess the AAPL premarket stock price ahead of the market session or view the after hours quote. View the Apple Inc real time stock price chart below to monitor the latest movements. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the AAPL quote.

Apple Stock Price Chart A pandemic-era surge in tech stocks has driven the major US tech companies to new highs, pulling US stock markets with them. The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. It also includes an industry comparison table to see how your stock compares to its expanded industry, and the S&P 500. Companies like Apple must beat collective market expectations of their earnings to positively influence their market capitalization.

It's no accident that they often manipulate their earnings reports to match or beat estimates to artificially enhance their stock prices. As a result, earnings management is highly scrutinized by the Securities and Exchange Commission . The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts.

Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. The Robinhood app can make trading easier for investors by analyzing stocks through the use of quick-to-open charts. You can quickly filter the chart from one day all the way to five years' worth of performance and tap your finger anywhere on the chart and get historical pricing.

NextBillion Technology Private Limited makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Unless otherwise specified, all returns, expense ratio, NAV, etc are historical and for illustrative purposes only. Future will vary greatly and depends on personal and market circumstances.

The information provided by our blog is educational only and is not investment or tax advice. Apple's stock has split several times since it first went public in December 1980. The first split came on June 16, 1987, on a two-for-one basis at a pre-split price of $79. The next split came on June 21, 2000, when share prices reached $111.

On Feb. 28, 2005, Apple split its stock again when it hit $90. The company split its stock again on a seven-to-one basis on June 9, 2014, when share prices reached $656. The final stock split came on Aug. 28, 2020, when it split on a four-to-one basis at a pre-split price of $499.23. We made this long, tedious joke about how Apple announcements don't move its share price for two reasons. First, investors obviously have no idea what any of the company's announcements mean.

And, second, because that fact mocks fans of the efficient market theory. Investors big and small now have loads more information than they did, and, in their view, Apple's shares are worth precisely what they were before. To understand and analyze the movement of Apple stock prices, you can see our price history table and real-time share prices above. Apple designs a wide variety of consumer electronic devices, including smartphones , tablets , PCs , smartwatches , AirPods, and TV boxes , among others. In addition, Apple offers its customers a variety of services such as Apple Music, iCloud, Apple Care, Apple TV+, Apple Arcade, Apple Card, and Apple Pay, among others.

Apple's products run internally developed software and semiconductors, and the firm is well known for its integration of hardware, software and services. Apple's products are distributed online as well as through company-owned stores and third-party retailers. The company generates roughly 40% of its revenue from the Americas, with the remainder earned internationally. You can see the uptick in the trend line after the split occurred, too. Many times when a stock split happens, more people invest which increases demand and, in many cases, the overall share price.

Apple's range of Mac products is another example of wildly successful Apple products. The iMac was released in May 1998, with Apple trading in penny stock territory at $7.58. While it didn't have an immediate impact on Apple stock, Apple traded at $9.22—a mere three months later. Apple's market cap is calculated by multiplying AAPL's current stock price of $172.19 by AAPL's total outstanding shares of 16,406,397,000. Apple Inc. is an American multinational corporation headquartered in Cupertino, California. It is the world's second largest information technology company.

Apple designs, develops and sells consumer electronics, computer software, personal computers, and online services. An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector. The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company.

In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares. Thanks to the astronomical rise over the years, Apple split the stock again in June 2014, this time seven-for-one. Three years later, in 2017, with Tim Cook at the helm and a services business providing a bulk of revenue, Apple's stock price is still steadily climbing. After Apple's first two-for-one stock split in June 1987, shareholders received two shares at a stock price of $41.50 each for their stock which had closed the previous day at stock price of $78.50. Lufthansa shares rose by almost 8.9% to €6.73 a share, and Air France KLM rose by 4.9% to €4.06. The stock chart to the left shows the price of Apple stock from the May 2011 to May 2012.

The corresponding bar graph on the bottom displays the average daily volume for Apple stock on any given day. For example, if 1 million shares of Apple were traded on a particular day where Apple was roughly at $100 per share, then $100M worth of Apple stock was traded that day. Apple Protocol is one of the latest protocol offering cutting edge DeFi services. AAPL will in future be the ultimate token for purchasing and trading apple stock.

With AAPL, users will be able to stake/farm with ease and confidence. Please read all scheme related documents carefully before investing. Past performance of the schemes is neither an indicator nor a guarantee of future performance. Groww is an investing platform where users can find the best mutual funds to invest in and can invest their money without any hassles. Groww provides objective evaluation of mutual funds and does not advice or recommend any mutual fund or portfolios.

On the other hand, each product had a noticeably positive effect on the stock over a longer period of time. The overarching, long-term view is the one to properly frame your investment decisions on, not day-to-day volatility. Over time, the market mechanism will identify true value in the marketplace.

Rely on the wisdom of the masses over the long term, not on the speculators that routinely come and go, thereby letting companies like Apple work for you. There have been few Apple product releases that immediately resulted in a meteoric rise in the company's stock price. Day traders are known to target Apple at the release of each of its products, but the quick riches that they seek are all too often a mirage that swiftly disappears. Before we delve into the product lines, it's important to remember a few key points about Apple's stock history. The company's stock trades on the Nasdaq under the ticker symbol AAPL. As of July 3, 2021, Apple had a market capitalization of $2.34 trillion, closing the trading day at $139.96.

The release of an innovative, revenue-driving product or service is one of the few options a company has to influence its stock valuation. When Wall Street valuations are right or wrong, the reward or loss can be astronomical for investors. This is because accurately estimating the impact of an internationally distributed product on a company's earnings and the company's stock is a herculean challenge.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.